Case Study: Competitive Analysis - University living

- Vivek Goyal

- Jan 18, 2023

- 3 min read

Updated: Dec 28, 2023

Objective

To perform a brief competitive analysis of the University Living business landscape and identify growth and improvement opportunities.

Method

A 4 steps method is used for this analysis as follows:

Identify competitors

Strategic Differentiation

Comparative feature analysis

Identify the scope of value offerings.

Comparative Analysis of Value proposition

We can analyze the value proposition based on 3 parameters:

● Strategic differentiation

How our current product is strategically placed i.e. What is our model? ○ Is it different from other competitors' models in terms of revenue generation? What are the pros and cons of it

What is the geographical footprint?

● Functional differentiation

How is the product placed in terms of features and services offered to the customers?

Is there any differentiating feature? if there are which are those for each of them and based on heuristics which has the most impact?

What kind of functional service is a strength of the product and should be adopted as soon as possible

● Actual Product Usage Experience ( UI/UX)

How are the user experiences of the Products Different

1. Identify Competitors

Through a collection of Google keyword searches, the following competitors are identified:

Amberstudent - https://amberstudent.com/

Uniacco- https://uniacco.com/

Nestpick- nestpick.com

Spotahome - spotahome.com

Website Analysis of University Living Among Competitors duration (Oct-22 to Dec 22)

Disclaimer- Website traffic analysis doesn’t give the complete picture of whole business operations (Marketing and sales (inbound + Outbound)). Hence, certain observations based on this data would need more input for deeper discretion.

Overall traffic performance comparison

Spotahome, Nestpick, and Amber students are globally popular.

However, University living is second only to Amber students in India.

Traffic and Engagement

University living falls 5th in global traffic (in comparison to these 5 platforms).

Nestpick and Spotahome prove to be global leaders.

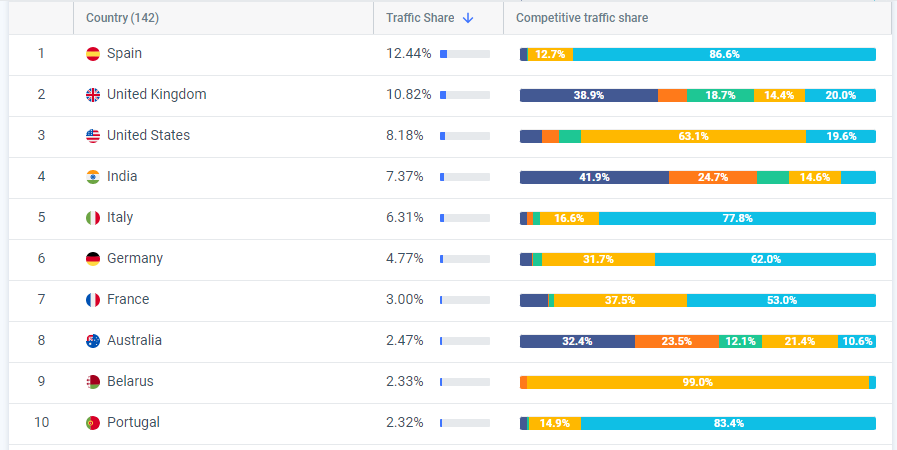

Geographical distribution traffic among the top 10 countries

Geographical distribution of University Living website traffic

India, the US, and Australia are the top 3 regions visiting the University Living website.

The above metrics gave us a brief overview of web traffic distribution on the 5 student accommodation providers that helped us gain a rough idea about the market distribution of the 5 companies. However, this does not represent actual sales and other important metrics.

2. Strategic differentiation

University living |

|

Uniacco |

|

Amber student |

|

Nestpick |

|

Spotahome |

|

Key Takeaways:

University living, Amber Student and Uniacco offer housing and accommodation services targeting the niche market of students.

Nestpick is an aggregator platform that fetches offers from housing and accommodation service providers. Like Trivago does for hotels.

Spotahome offers housing and accommodation solutions to the general market not targeting any specific niche.

From Web traffic analysis, the Top 5 countries where University Living is active are India, the UK, Australia, the US, and Sri Lanka

3. Comparative Feature analysis: Functional features with user experience

Features/Company | University living | Amber Student | Uniacco | Nestpick | Spotahome |

Room replacement | Yes | No | No | no | No |

International Money Transfer | Yes | Yes | No | no | No |

Room essentials | Yes, Selling directly at our e-commerce. | yes, But partnered with kit providers and the student has to request for quotes. This gives options to students however, this breaks the intended action. | No | no | No |

airport pickup | Yes, contactless option. | Yes, but students have to request quotes. That breaks the user's intended action. | No | no | No |

Education loan | Yes, the Best feature integration with UI | Yes | Yes | no | No |

Student internships | Yes | Yes | No | no | No |

Forex | Yes | Yes | No | no | No |

Health insurance- oshc | Yes | No | No | no | No |

International SIM | Yes | No | No | no | No |

Job search | Yes | No | No | no | No |

guarantors | Yes | Yes | No | no | No |

student bank account | Yes | Yes | no | no | No |

Travel Insurance | Yes | No | yes | no | No |

luggage storage | Yes | Yes | no | no | No |

food hub | Yes | No | no | no | No |

Visa assitance service | Yes | Yes | yes | no | No |

Scholarships | Yes | Yes | Yes | no | No |

Mobile app | Yes | No | No | no | No |

Price match guarantee | Yes | Yes | Yes | no | No |

No deposit | No | no | yes | no | No |

No visa no pay | no | no | Yes | no | No |

No university no pay | No | No | Yes | no | No |

User experience rating | User experience builds more trust at first experience. With features and services integrated in a user-friendly way such that every service is easy to find and access. Hence, 5 | user experience is user-friendly and easy to use. However, the services are not integrated as compared to University living. Hence, 4 | User experience is not immersive. It's a collection of pages with CTA to reach out. hence. 3 | User experience is good and services and features are easily accessible. hence 3 | User experience is remarkable.. Unable to access offerings comfortably. Hence, 2 |

Key takeaways:

In comparing features, the University beats all the platforms providing all necessary services specific to students looking for education abroad.

Uniacco offers economic benefits such as No Visa No pay, No deposits, and No university no pay, which differentiates it from competitors.

Nestpick and Spotahome being generic housing providers don’t provide value-added services catering to the student segment.

4. Recommendations (based upon both website and mobile app)

ß

To improve engagement.

Mobile app - Offer internship recommendations to mobile app users based on their location and education. This has the potential to increase user retention on mobile applications.

Mobile app - As the B2C market segment is moving towards community-driven. We should have a Community Forum feature to build a community of users where users can chat, and help each other. This feature has 3 main benefits:

It may help build a long-term relationship with users and organization.

It may help us learn more about user requirements and behavioral patterns

In the long term, this opens a gate for potential consumers (acquaintances, relatives, friends of current users, who might avail of our services)

To improve user acquisition-

Certain questions are required to understand the situation better

What is the current marketing strategy? Is it different based on the region?

What is the operational model of the organization across the regions?

Comments